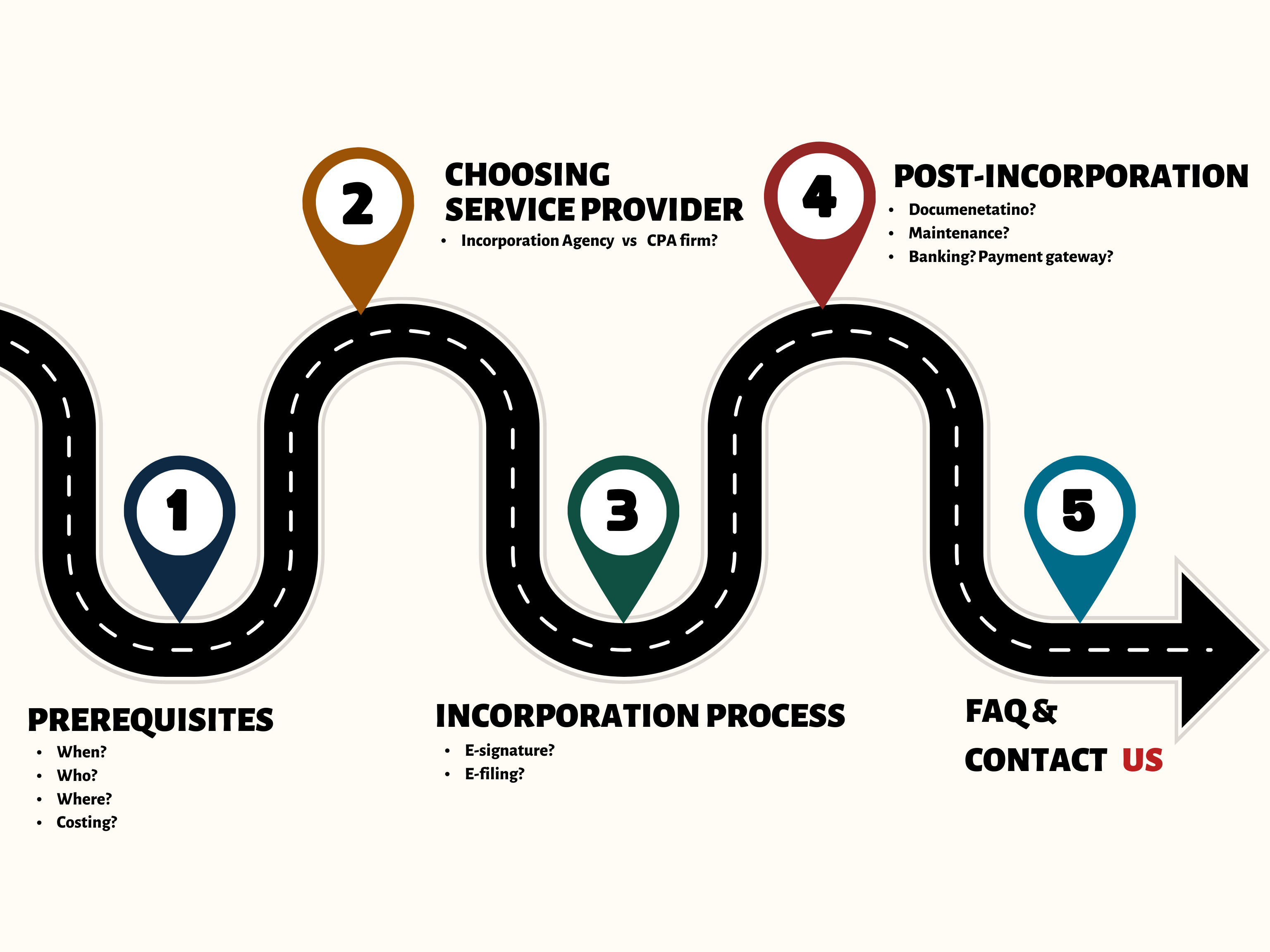

Registration of a company in HK doesn’t have to be complicated – we show you why.

Table of Contents

ToggleIntroduction

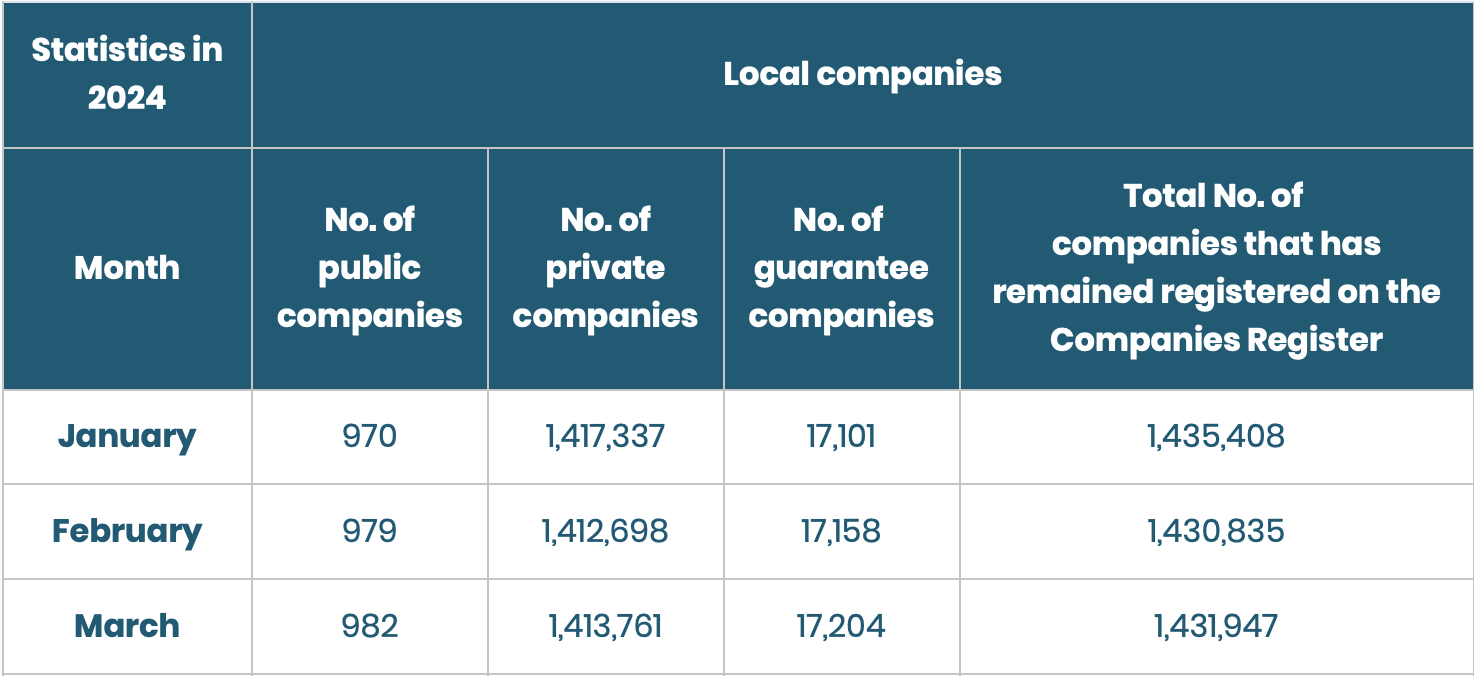

The numbers speak for themselves:

According to the latest official statistics from the Hong Kong government, there are over 1.4 million registered limited companies in Hong Kong as of the end of March 2024. That is not a coincidence: To set up a HK (Hong Kong) company is very easy, in particular, for online entrepreneurs since they can do it 100% remotely.

This article aims to provide foreign entrepreneurs with practical advice on how to set up a HK company, which is 100% foreign-owned with limited liability.

By following the steps outlined in this article, you will gain a clear understanding of the process of registration of a company in Hong Kong as a foreigner.

Important note:

Legally, as a foreigner, you can’t set up a HK company by yourself. The government rule states only a Hong Kong citizen (holding a Hong Kong passport) can set up a Hong Kong company.

We discuss this in more detail in section 2 of this article about the service provider.

1 – Before registration of company: What are the prerequisites?

1.1 – Before registration of company: Case Study

Before we delve into how to set up a company in HK as a foreigner, we present a recent client’s registration of a company.

Meet Mr. Zimmer, a German citizen, who operates a drop shipping business through Shopify in Germany. He decided to leave Germany and relocated to Bangkok, Thailand.

As he set up a company in HK (meaning: no residency) from Germany, he is not subject to German taxes. In a free consultation with Reachtop KSHK CPA, we found out:

- He pays 0% on company income tax as his customers are not from Hong Kong (Hong Kong Offshore Tax regulation)

- He pays 0% tax on his dividend payout in Hong Kong.

Whether it is completely tax-free now depends on how Thailand taxes personal income (see Thailand tax system and new 2024 tax regulation changes on foreign income in Thailand ).

Here is a summary of how his registration went:

Monday, 9 am:

Mr. Zimmer spent 5 minutes filling out an online form. He uploaded his German passport and proof of residency (the English rental contract for his apartment in Bangkok).

Monday, 3 pm:

Mr. Zimmer receives documents that he signs electronically.

Tuesday, 1 pm:

We informed him that his Hong Kong company had been successfully incorporated, and he received the company’s final documents via email.

Wednesday, 9 am:

Mr. Zimmer spent 30 minutes opening a bank account online with Airwallex. This involved undergoing facial recognition and uploading his dropshipping business history as part of the KYC (Know Your Customer) process. One week later, his Airwallex account was activated, and he collected his revenue through a payment gateway available in Hongkong such as Stripe.

The journey seems remarkably easy and fast, doesn’t it? Indeed, it is.

Let’s delve into the detailed requirements, which can be categorized into time, people, location, and documents.

1.2 – Before registration of company: Prerequisites

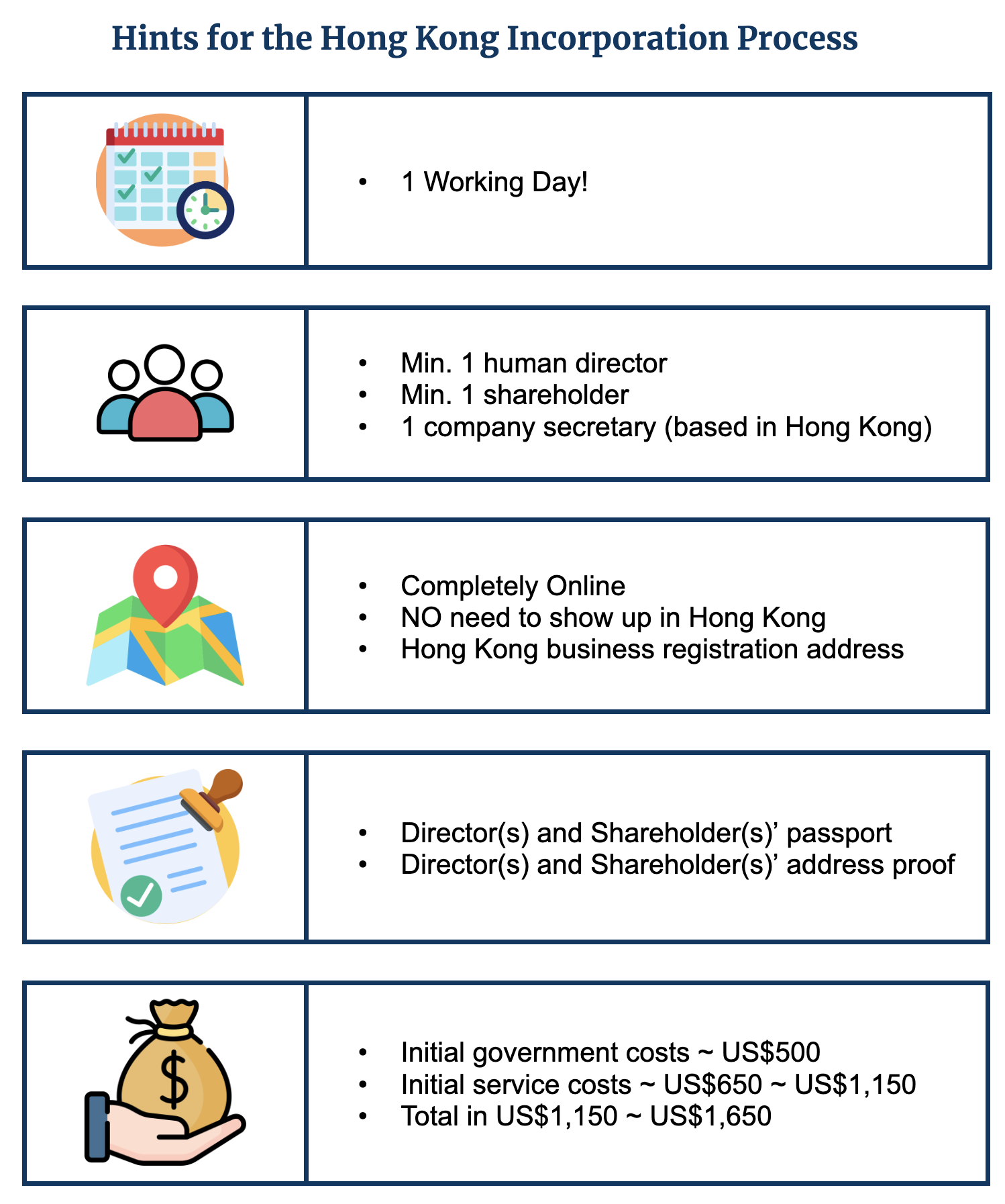

1.2.1 – Time – How long does it take?

Maximum 24 hours, depending on how fast you sign the application documents that are required to set up a company in HK.

1.2.2 – People – Who is involved in the registration process?

There are 4 parties involved in the setup of a HK company:

- Party 1 – You who want to set up a company in HK.

- Party 2 – Us (or any Hong Kong citizen) who set up your company as your legal representative.

- Party 3 – Us (or any Hong Kong resident) who will be appointed as your company secretary.

- Party 4 – Government authority who will check the application for the registration of your company.

1.2.3 – Location – Do I have to be in Hong Kong to set up a company?

No.

The company registration can be completed entirely online, without the need to visit Hong Kong. However, the company will require a business registration address within Hong Kong for correspondence purposes. This address can be a virtual address provided by your company secretary or a physical office address if the company owns an office in Hong Kong.

1.2.4 – Documents: What documents are required to incorporate a Hong Kong limited company?

You will need 3 documents (all in English):

- Passport copies for all directors and shareholders

- Address proof in English for all directors and shareholders (e.g. rental agreement, telephone bill)

- Proposed company name

1.2.5 – Cost: How much should you expect to pay for the whole incorporation process?

The average cost will be between HK$9,000 and HK$13,000. Choosing the right agency will be discussed further in the article.

2 – Before registration of company: Executing the incorporation plan – Finding your incorporation service provider

As mentioned before, as a foreigner, you may not legally set up a company in Hong Kong by yourself.

This means in order to set up a Hong Kong company, the very first step is choosing a service provider. There are 2 types of service providers: an agency or a CPA firm.

In order to understand the differences between the two, we’ll first present an analogy and then proceed with more legal details.

2.1 – Before registration of company: Analogy – Laptop store versus Apple store

Imagine the following situation:

You want to buy a Macbook.

You have the options to buy either at a laptop store where they sell various kind of laptops or at an Apple store. The laptop store will probably give you general advice on your Macbook purchase while the employees at the Apple store can give you very detailed information.

If you buy at the laptop store, after purchase they or you will have to contact Apple for repair or support. This is similar as if you had bought the Macbook straight from the Apple store itself.

At the end of the day, it’s a matter of taste. There is no right or wrong.

In this analogy, the laptop store is the Agency and the Apple store is the CPA firm. If you do the registration service or any accounting service with an agency, they will have a CPA firm behind the curtain to execute the steps.

2.2 – Before registration of company: Detailed comparison of service providers

2.2.1 – Overview

Option 1: Hiring an agency

There are many agencies that execute the registration process, but may have an accounting firm behind the curtain as they are not familiar with all the requirements.

Advantages

- Experience in the process of registration.

- Speak the language of customers.

Disadvantage

- Maybe more expensive.

Option 2: Hiring an accounting firm

There are accounting firms that are familiar with all the legal requirements for the registration and later on for the accounting.

Advantages

- Legally allowed to execute all steps within the registration process, be your company secretary, and be your accountant.

- Can give you proper legal consultations for your long-term business in Hong Kong.

Disadvantage

- May not speak the language of customers.

This section will discuss two main types of service providers, along with their respective pros and cons.

2.2.2 – Incorporation agency

Incorporation agencies are abundant and easily found through a simple Google search. They provide streamlined incorporation services, including company secretary services and a Hong Kong business registered office address. Most agencies also offer basic maintenance services such as annual company renewal, bookkeeping, and assistance with annual auditing and filing of profit tax returns.

If you are familiar with the incorporation rules and processes in Hong Kong, working with an incorporation agency can be advantageous due to their streamlined and efficient service systems. However, if you require tailored advice on company structure, tax consultation (such as offshore status based on your specific background or business), it is recommended to consider partnering with a CPA firm, as discussed in the next paragraph.

2.2.3 – Hong Kong-licensed CPA Firm

Hong Kong-licensed CPA firms, also registered under TCSP, can provide all the services offered by incorporation agencies. However, they also have an additional role as auditors under the company ordinance. All CPA firms in Hong Kong are managed by practicing CPAs who possess knowledge of the company ordinance, Hong Kong tax law, accounting, and auditing standards. While incorporation may not be their main business focus, they excel at providing tailored solutions for clients with unique backgrounds and businesses, particularly in areas such as tax planning, company structures, and operational support.

Unlike incorporation agencies, CPA firms are not merely agencies but comprehensive service providers. They are authorized to handle mandatory auditing and tax filing, and only practicing CPAs can sign the company’s audited financial statements.

3 – During registration of company: Incorporation Process

Once you have chosen a service provider, they will guide you through the documentation and incorporation process. The service provider will assist with preparing the necessary documents, including the Articles of Association and the application forms for company incorporation. The process generally involves the following steps:

3.1. During registration of company: Name Search and Reservation

Your service provider will conduct a name search to ensure the proposed company name is available and complies with the naming requirements. Upon confirmation, the name can be reserved for a specific period of time.

3.2. During registration of company: Document Preparation and Submission

As mentioned above, you need to provide the required documents, such as passport copies, address proof, and the proposed registered office address. Your service provider will prepare the necessary documents and submit them to the Companies Registry for incorporation by e-registry or physical form filing in special cases.

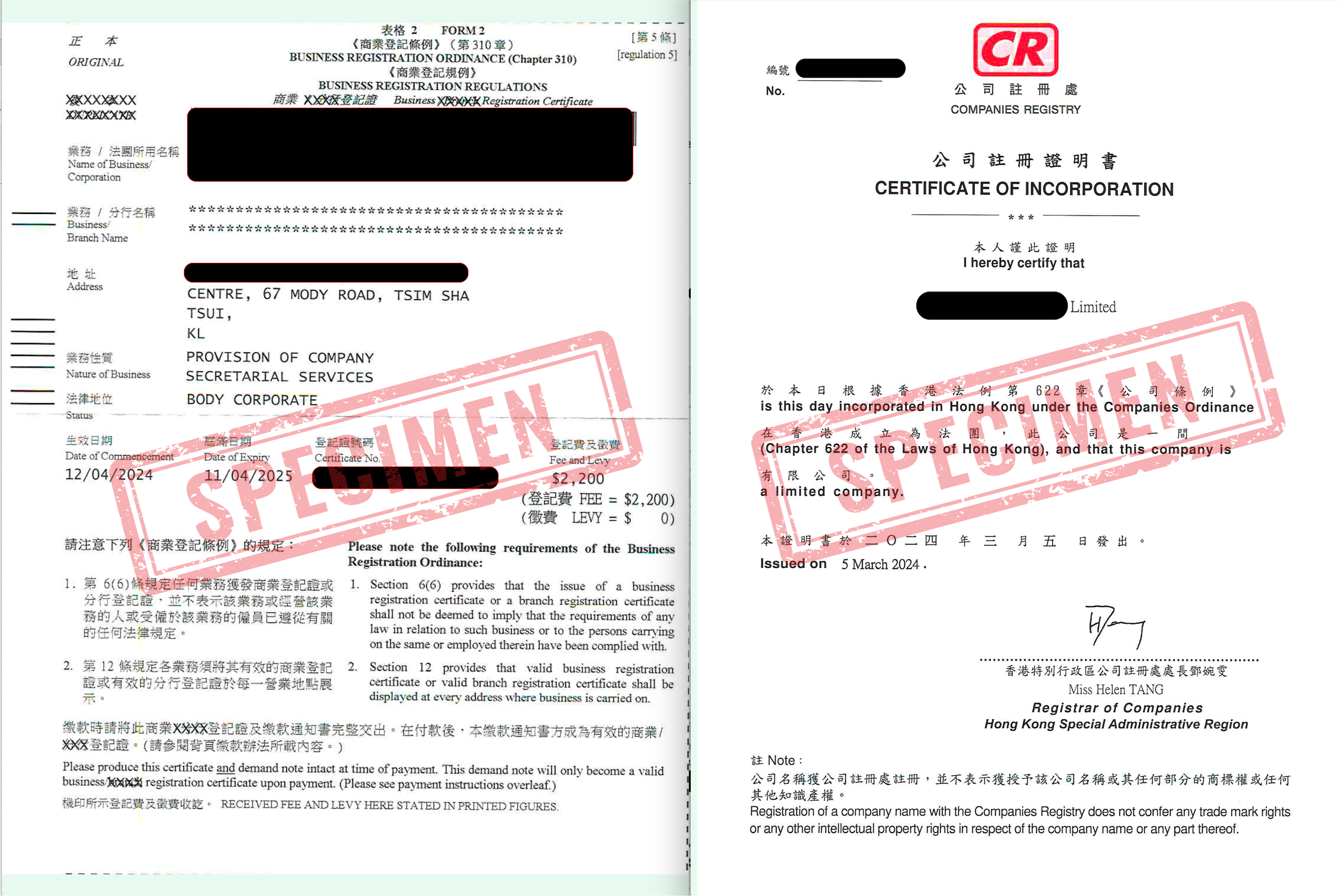

3.3. During registration of company: Incorporation and Registration

Once the documents are submitted, the Companies Registry will review the application. If everything is in order, the company will be incorporated, and you will receive the Certificate of Incorporation and Business Registration Certificate.

4 – After registration of company: Documentations you will get after successful incorporation

Here are the documentation and information that you will get after the incorporation.

| Documents | Purpose |

| ✅ Business Registration Certificate | 👉🏻 Providing company Tax number👉🏻 Providing registered office address |

| ✅ Certificate of Incorporation | 👉🏻 Providing company Tax number👉🏻 Stating the date of incorporation |

| ✅ Articles of Association | 👉🏻 Stating the company’s internal governance rules |

| ✅ Incorporation from – NNC1 | 👉🏻 Stating the company’s initial structure, list of director(s) and shareholder(s) |

5 – After registration of company: Obligations and Compliance

After successfully incorporating your foreign-owned company in Hong Kong, it is important to fulfill ongoing obligations and comply with local regulations. Here are some key post-incorporation obligations:

5.1 – After registration of company: Annual Compliance Requirements

Annual Return:

File an Annual Return with the Companies Registry, providing updated information about the company’s directors, shareholders, and registered office address. The Annual Return must be filed within 42 days after the anniversary of incorporation.

Financial Statements and Audit:

Prepare financial statements at the end of each financial year. Unless eligible for audit exemption, the financial statements must be audited by an auditor in Hong Kong.

5.2. After registration of company: Tax Obligations

Profits Tax Return:

Separate from the annual secretary service, the company will receive its first profits tax return (PTR) around 18 months after the incorporation date. To file this tax return, the company is required to prepare the financial statements and audit report on an annual basis, which the fee depends on the actual company’s size (i.e. revenue, structure, number of transactions, the nature of the business, etc.).

Tax Planning:

Engage with a Hong Kong-licensed CPA firm to optimize your tax planning strategies and ensure compliance with the local tax regulations.

5.3. After registration of company: Compliance with Statutory Requirements

Maintain Proper Company Records:

Keep up-to-date records of the company’s registers, minutes of meetings, and other relevant documents at the registered office address.

Notify Changes:

Inform the Companies Registry of any changes in the company’s particulars, such as directors, shareholders, and registered office address. Finding a trustworthy and responsive company secretary will make this part much easier~

6 – After registration of company: Business Bank Account Set Up

Following the successful incorporation of your company in Hong Kong, setting up your financial infrastructure is crucial for operational efficiency. This includes establishing banking relations and payment processing solutions. Here’s how to proceed:

6.1. After registration of company: Open a Company bank account for your Hong Kong company

After the company registration, you need to open a company bank account in order to receive money from your clients.

We advise you to go through the following steps:

Step 1: Choose between a virtual bank and a corporate bank

For most companies, a virtual bank is sufficient.

It is also the most convenient regarding setup and support (no need to be in Hong Kong).

Further reading:

When choosing a virtual bank or a corporate bank?

Step 2: Choose a bank

Once you have decided on a virtual or a corporate bank then you need to choose a specific bank among those.

Here are some reputable banks for each of those:

Corporate banks:

- HSBC (Hong Kong and Shanghai Banking Corporation),

- Standard Chartered Bank, and

- DBS Hong Kong

Further reading:

How do corporate banks differentiate from each other?

Virtual banks:

- Airwallex,

- Currenxie,

- Statrys, and

- Wise

We at Reachtop help our clients each step along the way to open a bank account. If you want to know what this looks like, book a consultation with one of our legal experts.

6.2. After registration of company: Payment Gateways Setup for E-commerce in Hong Kong

For businesses in the e-commerce sector, setting up payment gateways is an urgent and crucial step.

There are providers such as

Further reading:

Which are the best payment gateways to choose for your Hong Kong company?

Registration of company: Conclusion and next steps

Incorporating a limited company in Hong Kong is a relatively straightforward process with minimal requirements. By following the necessary steps and working with a reputable service provider, you can establish your business efficiently. After incorporation, it is vital to fulfill ongoing obligations and comply with local regulations to ensure the smooth operation and compliance of your company. Seeking professional advice from a CPA firm can be beneficial for tailored solutions and comprehensive support in areas such as tax planning, company structures, and ongoing compliance.

Questions other readers have asked.

1 – How much does it cost to set up a company in HK?

It really depends on the level of services you may require, but in normal speaking, US$1,150 ~ US$1,650 will be a reasonable budget for the incorporation and inclusive of the first 12 months maintenance cost.

2 – How long will it take from start to finish to set up a company in HK?

Under the e-registration, the government takes only 1-2 working days for issuing the incorporation certificate.

3 – What are the usual pitfalls when foreigners set up a company in HK?

Usual pitfalls can be that Hong Kong company is not the best option for your business and personal case. This is a consequence if you have not been consulted by a legal expert.

Book a consultation with our legal expert to see whether and how a Hong Kong company is suitable for your business in the long run.

4 – Is it possible to set up a company by myself?

Yes, if you have a Hong Kong passport.

Otherwise, no.

This means most foreigners (Americans, Europeans) will need a service provider for the registration of a company in HK.

5 – Can foreigners own a company in Hong Kong?

Yes.

The requirements are

- Being over 18 years old

- Having the required documents (passport, proof of residency)

6 – What is the minimal investment capital for a HK company set-up?

Minimum HK$1.

7 – Does a company need to keep hard copies of its documentation?

Yes, the business registration has to be kept and visually displayed as a hard copy at the registration office.

All other documents are digital.

Also, you will not receive a common seal as there are no requirements for that.

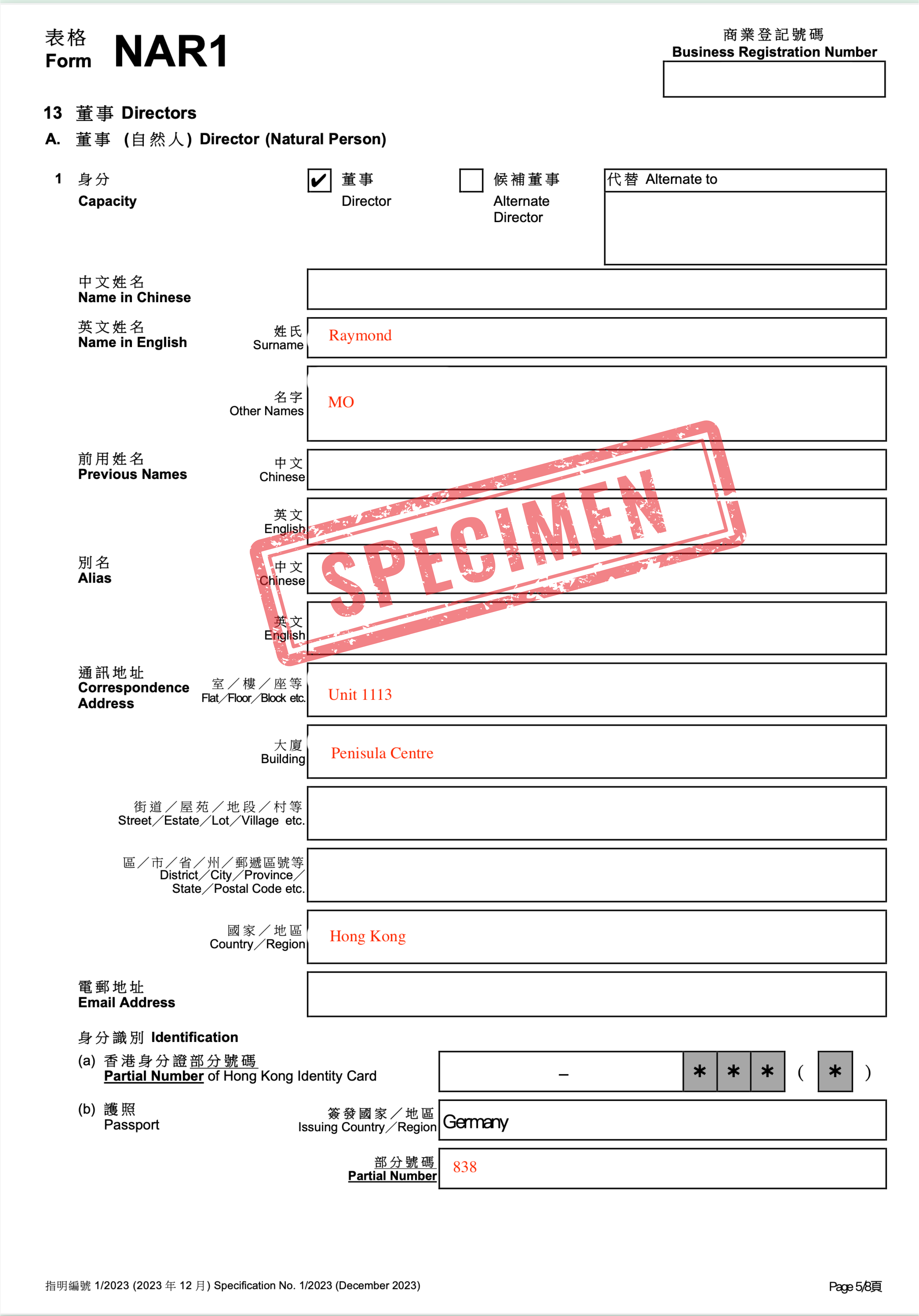

8 – What information about directors is disclosed to the public?

The following information is displayed to the public:

- Full name,

- Correspondence address,

- Nationality, and

- Partial information from the passport number.

See the specimen of the public form below.