Digital vs. traditional banks for your business account in Hong Kong?

We break down the decision process for you.

Read the below article and if you have any further questions or need help with setting up the right legal foundation for your investments, then reach out to us any time for a free consultation call.

Notice: All our consultation calls are conducted by an experienced CPA whose knowledge is based on legal sources. There is not a salesperson without proper domain knowledge and just hoping to close a deal.

Introduction:

In year 2016 HSBC, one of the largest banks in Hong Kong, terminated several business accounts due to stricter legal laws (KYC) to combat money laundering.

This also included the bank accounts of many foreigners.

There’s nothing more frustrating than your daily operations being stopped, by the termination of your bank.

How this article will help you?

This article will help you to make a good bank account choice for your business that fits your situation.

We believe a business owner should focus on his daily operations instead of banking issues.

The structure of the article.

Foreign-owned businesses can choose two types of banks to work with:

- Traditional banks, e.g. HSBC

- Virtual banks, e.g.

In this article, we discuss:

- What do these two bank types mean?

- What are the main differences in service between these two bank types?

- When do foreigners choose a virtual bank?

- When do foreigners choose a traditional bank?

- Your next action steps after reading this article

- Conclusion

1 – What are virtual and traditional banks?

1.1 – Traditional banks: Definition and examples

Definition:

Banking options for foreign-owned Hong Kong companies have traditionally involved setting up accounts with traditional banks. Hong Kong, being a renowned global financial center with over 150 licensed banks, has been the go-to choice for many clients.

Examples:

The most popular banks among those are

- HSBC (Hong Kong and Shanghai Banking Corporation),

- Standard Chartered Bank, and

- DBS Hong Kong

You can find a more detailed comparison between these banks in this article.

1.2 – Virtual banks: Definition and examples

Definition:

Over time, the banking landscape has evolved, and virtual banks have come into place.

They serve as platforms that facilitate seamless operations and have no branches, thus they interact completely digitally with their customers.

Nonetheless, these banks need a presence and registration in Hong Kong to operate for Hong Kong companies, as they eventually access banking services through traditional bank accounts.

Examples:

Alternative options to traditional banks, particularly virtual banking (also known as Fintech banks, online banks, Nano banks), have gained popularity amongst foreign-owned companies. Platforms like

These are solutions very similar to Wise and Revolut.

Side note:

Revolut Business is not yet supported in Hong Kong.

Click here to see the supported countries by Revolut.

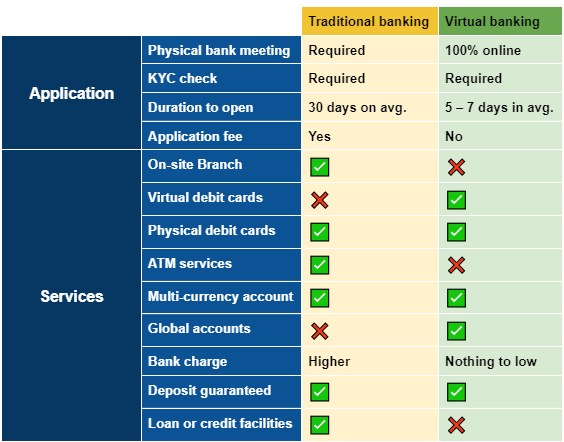

2 – Virtual vs. traditional banks: What are the differences?

Let’s deep dive and explore the differences between traditional and virtual banking in Hong Kong and their application processes and services:

3 – When to choose a virtual bank?

3.1 – Reasons for choosing a virtual bank

Having worked and talked daily to our European and American customers with a foreign-owned company, we noticed these common reasons that made foreigners choose a virtual bank over a traditional one.

Reason number 3 is the most important one according to our survey.

Reason 1: Fewer costs

Usually, a virtual bank will lead to lower costs over a year due to the following facts:

No transaction fees and multi-currency accounts.

Traditional bank’s transaction fees can amount to a considerable amount if the number of transactions increases.

This amplifies if the traditional bank does not have the currency you are being paid in, and you need to pay transaction costs for every currency exchange.

In particular, for e-commerce owners, this can be a very good reason to choose a virtual bank over a traditional bank as they have

- many smaller incoming transactions per month

- different currencies to deal with (e.g. paying suppliers in China in Yuan, freelancers in India in Rupee and customers paying the shop in USD or EUR)

No application fee.

Also, there is almost no cost for the application for virtual applications.

No need to pay for flights and hotels.

As there are no physical meetings with a virtual bank, there is no need to book flights and hotels to stay in Hong Kong.

Reason 2: More financial flexibility

Virtual credit cards are one of the many interesting features of virtual banks.

You can create as many credit cards and you will see all of them in your app.

You can then hand the numbers for those credit cards to your staff or freelancers to pay expenses on behalf of your business.

Of course, you can lock the credit card in the app at any given time and also assign limits (depending on the virtual bank).

Reason 3: Seamless technology

Virtual banks are technically more modern as many of them already have native integrations with

- other bookkeeping tools (Xero, Quickbooks), and

- other payment gateways (e.g. PayPal, Stripe).

To understand more about payment gateways, you can read more here.

Reason 4: Less time-consuming

Usually, virtual banks will take less of your time thanks to

- easier KYC checks

- online meetings (no physical meetings in Hong Kong compared to traditional banks)

- a faster application process (just a few days)

Especially, online meetings are one of the most important reasons for many foreigners to choose a virtual bank.

3.2 – Case Study: French Amazon Seller chooses Airwallex

One of our clients is French by nationality and resides in Thailand.

He is an Amazon seller with stores in Europe and the US, with Chinese suppliers and freelancers based in the Philippines.

Due to the COVID-19 pandemic, the director was unable to visit Hong Kong for traditional bank meetings and opted for Airwallex accounts.

Apart from no need for physical bank meetings, virtual banks offer a lot of flexibility for e-commerce businesses that involve frequent payments to foreign suppliers in different currencies, e.g.

- receive deposits from different currencies,

- pay suppliers in USD via the FSP system with zero bank charges, and

- transfer monthly salaries to freelancers in the Philippines using the global account with no additional fees.

Virtual debit cards were assigned to different staff worldwide for daily business expenses, and the owner could easily withdraw funds to their personal bank account in Thailand.

For audit and tax reporting, the company provided access to its Airwallex platform and integrated Xero accounting software, simplifying transaction records and supporting checks.

4 – When to choose a traditional bank?

While virtual banking offers numerous advantages, it may not be suitable for businesses requiring more extensive banking services such as investment accounts or banking facilities like credit cards and loans. These services are typically offered by financial institutions with traditional banking licenses.

Except for businesses that heavily rely on cash or paper check payments, most businesses can benefit from virtual bank accounts.

5 – Conclusion & next steps

Virtual banking options have revolutionized the banking landscape for foreign-owned Hong Kong companies. They offer flexibility, cost-effectiveness, and streamlined services, particularly beneficial for modern business models. While limitations exist, virtual banking has proven to be a viable and efficient alternative to traditional banking, empowering businesses to thrive in Hong Kong’s dynamic economy.

After you have read this article, we recommend these next steps:

Step 1:

Based on the reasons above, choose your preferred bank type (traditional vs virtual banks).

Step 2:

Once you have chosen the type of bank, research which bank is best for you.

If you choose a traditional bank, then this article discusses the best corporate banks.

If you choose a virtual bank, then we will soon publish an article on the best virtual banks.

Step 3:

Prepare all required documents for opening a bank account as discussed in this article.

Questions other readers have asked

1 – Which documents are required to apply for a traditional or virtual bank?

You can read the requirements and needed documents for an application here.

2 – Is it safe to hold large amounts of money in virtual bank accounts?

Yes, virtual banks provide different levels of protection for the money stored in their bank accounts.

Fintech companies like Airwallex don’t physically hold your money themselves; instead, they utilize traditional bank accounts.

They offer high levels of security and protection, guaranteed by the local government’s deposit insurance. You can read more about this when you invest in Hong Kong.

3 – Have your customers ever experienced a virtual bank freezing their account and money? If yes, are there ways to prevent this?

Yes, it does happen from time to time. This issue is not related to a digital bank.

Both, digital and traditional banks licensed in Hong Kong adhere to strict anti-money laundering (AML) rules. They are particularly cautious when it comes to transactions involving sensitive countries or districts and significant amounts of money. To avoid any issues, it is crucial to maintain proper records of your transactions, including invoices, business contracts, and other necessary documentation. Having these ready when your banker requests them is important. Generally, as long as your business complies with AML rules, there is no risk of having your account frozen.

One additional point to consider is that AML and Know Your Customer (KYC) regulations are receiving increasing emphasis from governments worldwide. Banks are particularly vigilant to avoid hefty penalties for non-compliance. Therefore, it is becoming more and more important to maintain accurate business and tax records to ensure the smooth operation of your business, particularly when it comes to banking relationships. Having a Hong Kong limited company can provide you with a way out through the mandatory annual audit and tax assessment process, which helps to demonstrate your business’s legitimacy and compliance.

4 – Can I receive payments from global payment gateways (PayPal, Stripe, etc.), and if yes, anything I need to pay attention to?

Yes, virtual bank accounts often integrate seamlessly with popular global payment gateways like PayPal and Stripe. This allows businesses to receive payments from customers around the world directly into their virtual bank accounts, simplifying the payment collection process.

5 – Can I integrate virtual bank accounts with accounting software?

Many virtual banking platforms offer seamless integration with popular accounting software. This enables businesses to streamline their financial management processes by automatically syncing transactions, generating reports, and simplifying bookkeeping. Integration with accounting software like Xero, QuickBooks, or other compatible platforms can save time and enhance accuracy in financial record-keeping.

6 – Can I make international transactions with virtual bank accounts?

Yes, virtual bank accounts generally offer the capability to make international transactions. They often provide multi-currency accounts, allowing businesses to send and receive payments in different currencies, making it convenient and cheaper for international trade and cross-border transactions.

7 – Can I open a digital and a traditional bank account simultaneously to benefit from both?

Sure, and that is what most of our clients choose to do. You can certainly run your business by relying solely on either type of banking.

In practice, many of our clients have never used traditional banks, as they find digital banking services sufficient for their needs. However, there is also a significant group of clients who utilize a combination of both digital banking and traditional banking. They have specific requirements, such as access to credit and loans, which digital banks may not offer.

8 – Can I later still change to a traditional bank if I am not happy with a digital bank account?

Yes, absolutely. Your digital banking record will even be a valuable asset when applying for traditional banks. Generally, traditional banks require more extensive business documentation during the application process. Having a solid record of your banking activities with virtual banks can serve as an advantage, as it demonstrates an existing business history and financial track record. This can help build trust with traditional banks and increase the likelihood of a successful application.

9 – Digital banks don’t have ATMs, correct? Then how can I withdraw cash if needed?

As per our knowledge, there are currently no virtual banks that provide ATMs. If you need to withdraw cash, you would transfer the money to your personal bank account and withdraw it from there. However, it’s worth noting that virtual banks commonly offer debit card services, which are typically sufficient for covering most business expenses. You can use the debit card for everyday transactions such as purchasing office supplies or grabbing a coffee from a local supermarket or café.

10 – Is there any limitation on money transferring to my account from the business account? Is there any tax implication?

There are no limitations to conducting money transfers in and out of Hong Kong. You have the freedom to transfer funds to any destination at any time and in any amount. Hong Kong is known for its unrestricted money flow policies. Importantly, there are no tax implications beyond the flow of money in and out of the country, thanks to its simple tax system. The business will only be subject to profit tax, which is determined based on the company’s annual audited financial statements, rather than individual bank statements.