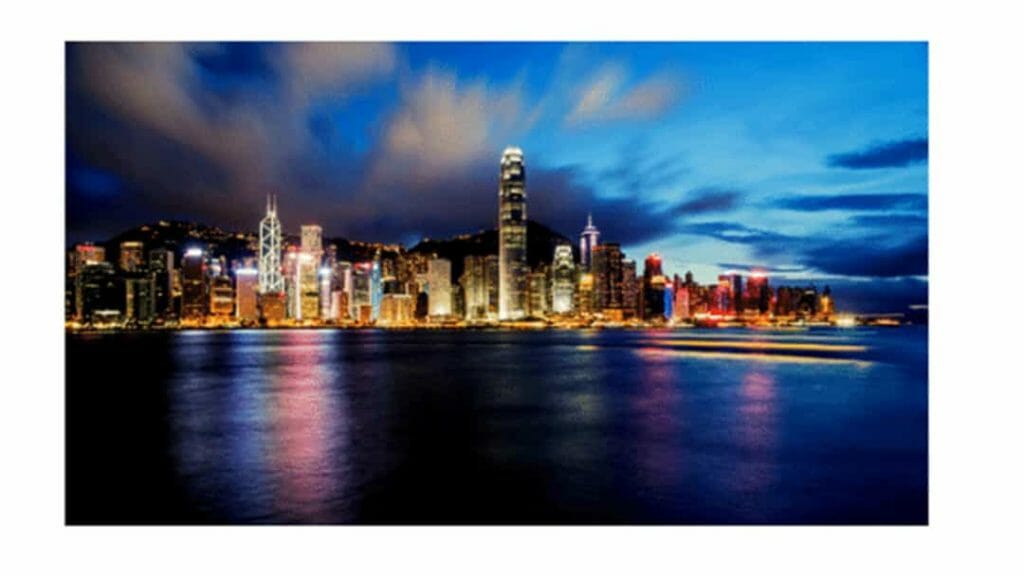

According to the Economic Freedom of the World 2021 Annual report, Fraser Institute ranked Hong Kong as the world’s freest economy, surpassing 164 other major cities and countries.

With this, Hong Kong yet again demonstrated its commitment to building a free global economy.

This means, if you are looking to set up a company in the world’s premier gateway to global business, this is the right time to start. And one way to do so is to buy a Hong Kong offshore company with a bank account.

Table of Contents

What does it mean to buy a Hong Kong company with a bank account?

Buying a Hong Kong company with a bank account means acquiring a company and informing the bank officer about the change in ownership.

The next step is for the bank to put the Ultimate Beneficial Owner (UBO), and new directors and shareholders through the appropriate standard due diligence check.

Note that buying an HK company with a bank account does not mean absolute assurance that the bank account will remain open.

In other words, the only difference between setting up a new HK company and buying one with a bank account is that with the latter, you have acquired a company with an already existing business history.

For example, in contrast to newly established companies, you are starting with a business with existing customers.

Challenges You Will Face if You Buy a Hong Kong Company With a bank account

Ideally, owning and operating Hong Kong offshore companies means doing business in a tax-efficient and low cost business environment.

You may not need to open a bank account, and you have the advantage of an already existing customers’ base. However, this may also mean inheriting the previous owner’s liabilities and business history.

Moreover, the beneficial owners, new directors and shareholders will still go through careful investigation , and banks have the discretion to terminate an account that comes into question to the bank officer.

Here are other challenges you will face when you decide to buy a Hong Kong company with a bank account:

- Tight guidelines in opening corporate bank accounts

- Challenges in presenting evidence to prove ties in HK

- Possibility of settling for a digital banking option

- Risk that the bank will close the account after careful examination of UBO, and you will end up eventually representing yourself at the bank to open a new bank account in Hong Kong

Hong Kong company formation with bank account

Here are hassle-free steps to take into consideration if you plan to open a business bank account for the purpose of setting up your Hong Kong company:

Choose the bank

Choosing a bank that suits your needs can help get your Hong Kong company hit the ground running. Generally, Hong Kong companies will have no trouble finding a bank that suits their needs.

Prepare the documents

You can expect the paperworks and requirements to differ depending on the bank and your preferred account type. In any event, you’ll have a wide range of options, provided that you can present the needed documents.

Documents required for bank account opening

- Proof of residency of HK directors, shareholders;

- Passport or identification cards of company directors and shareholders;

- Copy of the company’s Articles of Association and/or Certificate of Incorporation

- A certified true copy of Business Registration Certificate

- Audited financial statements

- Minimum deposit

Note that the required documents may differ across banks. You can find information about the documents specified by the bank in the application form.

Hong Kong banks may also ask you to present information about your nationality, employment history, salary and tax residency information. Other required documents may include certification by either a banker, lawyer, notary public or a certified public accountant.

Submit your application

Present documents, including the identification cards of founders and representatives to your selected bank. You can also avail of the online bank service, where you can open a bank account even without visiting Hong Kong.

Select preferred options

The complete process to open bank accounts in Hong Kong is fairly easy. The general rule is to select the bank and account type that suit your needs and preferences.

Hong Kong banks offer a wide range of options, where clients can select bank accounts that cater to their specific banking needs. Here are the common bank account categories in HK:

Savings accounts

This is an interest-earning type of bank account, where you can withdraw funds anytime. Moreover, you can draw-out your money without penalty.

Current accounts

Unlike a savings account, a current account does not earn interest. The advantage of this type of bank account, however, is the flexibility in making payments through cheques.

Fixed/Time deposit

A fixed/ time deposit bank account is recommended if you plan to save your money for a specific period of time. You earn a higher interest rate than you would with a savings bank account.

Non-HKD deposit account

Opening a non-HKD deposit account is another option for a Hong Kong based company.

Hong Kong banking institutions support the operation of offshore companies by offering services where clients can open accounts in a wide range of currencies

Integrated account

Integrated bank accounts are those that offer depositors an all-in-one access to a wide range of banking services. Account holders of this account are in a better position to manage finances, given their access to an overview of the entire financial situations.

Investment account

You can also become a bank account holder by opening an investment account. Other than operating a Hong Kong offshore company, this type of account will also allow you to trade stocks, subscribe to certificates of deposits and pursue other investment strategies.

Hong Kong Banking

Many owners of foreign companies were attracted to Hong Kong with its well-regulated banking system and banks that are financially sound.

Hong Kong is an attractive financial hub with its banks that offer several banking options for local and foreign company operations.

However, there are several factors that you have to consider when opening a corporate bank account in Hong Kong.

How difficult is opening a bank account in Hong Kong?

In observance of due diligence, the Hong Kong Monetary Authority requires a face to face meeting with the bank signatory is required in opening bank accounts.

Opening accounts in HK has become more difficult, as Hong Kong Monetary Authority has strengthened measures to prevent money laundering schemes.

For example, evidence of registered address and existence of a local office is required for both foreign and Hong Kong companies.

Moreover, Hong Kong banks impose high bank fees and charges. HSBC, for instance, imposes a monthly fee of HK$60 for bank accounts with an average balance below HK$5,000.

If you will be visiting Hong Kong to open an offshore bank account, we suggest working with a CPA who is in the best position to assemble the documents and help with the processing of your application.

Alternatives to opening an account with traditional banks

With Hong Kong banks trying to mitigate risks, it is likely that you will face difficulties opening an account with a traditional bank. But who said you are confined to using banks alone for banking services?

Hottest Fintech Platforms available in Hong Kong

Fintech solutions are a good alternative to traditional banking services. With a modern approach to banking, Fintech is a one stop solution that can fulfill most of the basic roles of a bank.

Neat

NEAT Financial Services is an innovative financial services provider that offers comprehensive financial planning. The firm was founded in Hong Kong in 2015, with the goal to help promote global trade through its global financial services.

The NEAT financial solutions help businesses scale their operation with the assistance of experienced, professional advisors. Some of the NEAT financial services include business accounts, corporate cards, international payments and company registration.

Airwallex

Airwallex is a global payment platform that allows businesses to simplify their transactions. Users can easily integrate Airwallex with online stores, such as Amazon, Shopify, and eBay.

Some of the advantages of Airwallex includes:

- Trade globally

- Collect and spend foreign currencies without worrying about conversion fees

- Zero transactions fees

Currenxie

Currenxie is a fintech solution that helps to simplify global payments. With its unique business model, you can have a single account that replaces all other financial service providers.

Entrepreneurs will not have to worry about multi-currency transfers, with Currenxie’s global bank account network. You can pay and get paid locally, as we will issue you a unique virtual account that will allow you to bank virtually everywhere.

Statrys

Many entrepreneurs and SMEs have found ways to handle their payments with Statrys Payment Services.

Statrys Payment Services is a leading payment processor committed to providing businesses with faster, safer and transparent transaction services. This fintech platform offers an array of e-commerce solutions, from credit card processing, merchant processing, money transfer services, and trade financing.

Why is Hong Kong considered a top offshore jurisdiction

Despite its strict bank opening guidelines, Hong Kong remains an appealing center for businesses, being a logistics and financial center across Asia.

Companies in Hong Kong have the advantage of a strategic location that reaches, not only the Asian markets but also world customers.

Here are reasons why Hong Kong is considered a top offshore jurisdiction:

World-class business and financial hub

Hong Kong prides itself on being the freest global economy for the past two decades. It has maintained this position because of its open market that welcomes even a non-resident to do business in the city.

In response to the pandemic, Hong Kong closed its borders to the rest of the world. However, top officials carved out exemptions for bankers and other business executives.

Stable reputation that enhances international trade

With a stable reputation for international business, many international banks opted to establish their business in Hong Kong.

The Bank of America, for instance, has 3 branches that cater to Hong Kong companies and residents. With the establishment of international banks, offshore banking has become easier.

Beneficial for startup companies

As a tax haven and financial center, Hong Kong is a great place for the incorporation of new companies.

Both Hong Kong residents and non-residents who can present sufficient company documents can have their companies incorporated.

How to set up a company with a bank account with Reachtop KSHK

As a licensed CPA firm, Reachtop KSHK CPA Limited knows the challenges of starting your company in Hong Kong, especially when opening a local corporate bank account.

Over the years, we have assisted with the incorporation of businesses taking our services further by helping with their local and offshore banking needs using the latest global banking solution to seamlessly run business.