Table of Contents

ToggleIntroduction:

As a CPA and owner of a licensed CPA firm in Hong Kong, we’ve had the privilege of guiding numerous foreign entrepreneurs through the complexities of setting up and maintaining their businesses here.

It is good to have background knowledge about the importance of your Hong Kong company address and what consequences it can have on your business.

What is this article about?

This article is about why you need to register an office address for your Hong Kong business and why many Hong Kong business owners choose a virtual office in Hong Kong instead of a physical one.

Who should read this article?

Hong Kong business owners or those who want to become one, in particular foreign business owners who have an online business.

When should you read this article?

You should read this article when you register your Hong Kong company or change your office address.

What are these prerequisites to execute the steps in the article?

The prerequisites are

- Registry of your Hong Kong business (read how to set up your Hong Kong company in 24 hours)

- Understanding the differences between agencies and accounting firms (article coming soon)

What are the outcomes of this article?

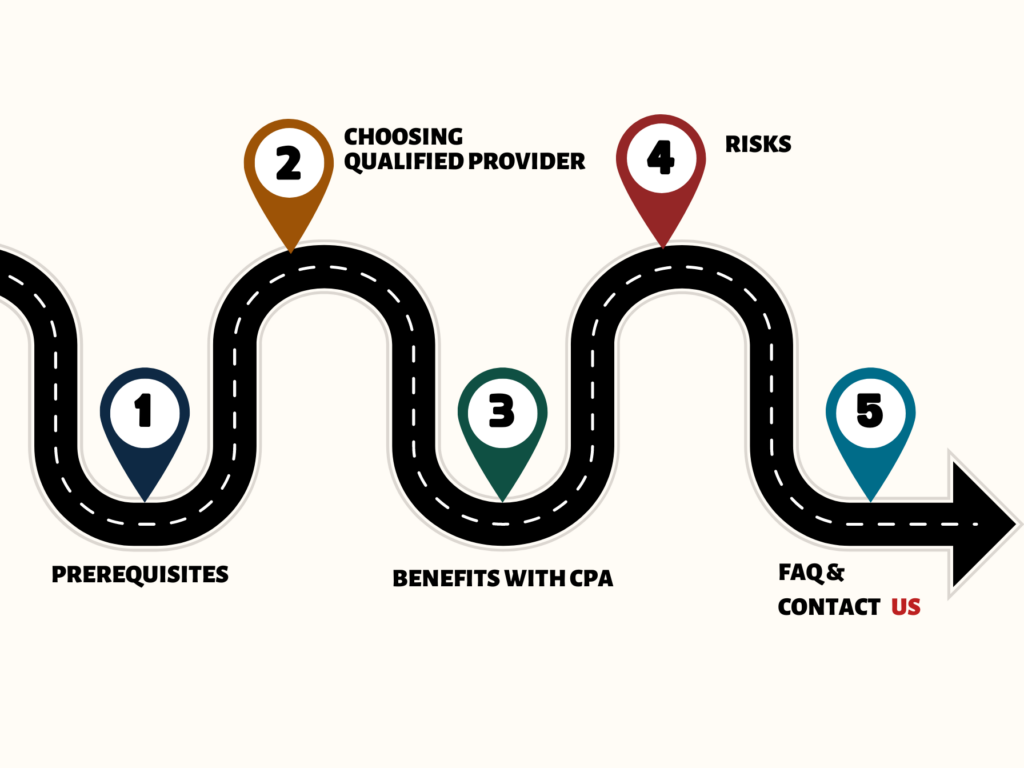

After reading this article, you know

- The importance of a Hong Kong virtual office address in compliance and brand perception.

- Practical considerations for choosing a virtual office provider.

- The potential risks associated with certain virtual office addresses.

- The benefits of partnering with reputable and professional firms, such as CPA firms.

1 – Virtual office Hong Kong: Why Do You Need the Registered Office?

1.1 – Virtual office Hong Kong: Legal Requirements:

A registered address in Hong Kong is a legal necessity for company registration in Hong Kong. This address will be public and is essential for receiving government correspondence and legal notices.

For a registered office, you have a choice between a virtual or a physical office.

1.2 – Virtual office Hong Kong: Enhancing Corporate Image:

A prestigious virtual office address in a recognized business district can significantly enhance your company’s image, sustaining greater confidence among clients and partners.

Depending on your clients, this can be an unfair advantage because some clients care about where the service provider is located.

2 – Virtual office Hong Kong vs physical office

2.1 – What is a virtual office

A Hong Kong virtual office is an office that is never used in real life for your operations (no employees working on site).

A virtual office is the best choice for fulfilling the minimum legal requirements for Hong Kong business while still making it cost effective.

2.2 – What is a physical office

A physical office is the normal office where employees and managers go physically and execute their tasks.

Physical offices were very common before Covid 19, where everyone would work from an office. After Covid 19, more and more companies started to work remotely and physical offices became less relevant.

2.3 – When to choose which

In order to make a decision which one to choose, you should consider the following aspects

- Cost: A physical office is more costly than a virtual office

- Nature of business: There are businesses that require physical locations, such as hospitals and manufacturers.

- Status: In certain business fields, an office (its location, its size, its view) can be a sign of prestige to serve clients such as business consultations, law firms, and IT firms.

3 – Virtual office Hong Kong: What to consider when choosing one.

Practically anyone with an office space or address in Hong Kong can provide a registered address for your virtual office.

There are a few very important aspects that you should consider before choosing a partner who provides a virtual office in Hong Kong to you.

3.1 – Virtual office Hong Kong: Legal requirement

According to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), a registered office address provider must hold a Trust or Company Service Provider (TCSP) license. This licensing ensures compliance with Hong Kong’s strict regulations aimed at preventing financial crimes. Without a licensed provider, your company risks non-compliance, which can jeopardize legal standing and disrupt business operations.

Practical example: If your provider lacks a TCSP license, you could face interruptions in receiving crucial government notices, potentially leading to legal complications and operational setbacks.

3.2 – Virtual office Hong Kong: Fulfilling the legal responsibilities

Good communication between you and the virtual office staff in Hong Kong

The tax department will regularly send mails to your virtual office such as

- Forms for the yearly employer’s return

- Business certificate after registration of your Hong Kong company

- Fines and other legal documentations

This requires the person at the virtual office in Hong Kong to notify you when you receive mails and more importantly do this in a timely manner in order to not miss deadlines.

Display the business certificate at the virtual office

By law, the business certificate has to be displayed at the virtual office in Hong Kong at all times. Not obeying the law can result in fines.

3.3 – Virtual office Hong Kong: Benefits of Partnering with a Licensed CPA Firm

Choosing a CPA firm licensed to offer TCSP services provides significant advantages, especially for foreign owners unfamiliar with local regulations. A licensed CPA firm adheres to the highest standards of professionalism and compliance, ensuring that your business meets all legal obligations efficiently.

3.3.1 – Professional Affiliations:

When you work with a CPA firm, it puts you in a better light in front of legal authorities such as tax departments, banks (especially corporate banks) and payment providers.

The reason is that CPA firms are very trusted entities because their customers go through a robust KYC process (know your customers).

When a CPA firm vouches for a client, banks are reassured of the client’s credibility and are more likely to fast-track their account openings. This reduces the risk for banks and streamlines your business setup.

3.3.2 – All-in-one-solution:

Not all virtual address providers are equipped to handle accounting or tax services. This is where partnering with a CPA firm can reduce workload for you.

They not only help collect these important letters but also streamline the next steps. Being qualified to handle both auditing and tax filing, a CPA firm can save you significant time and effort that you would otherwise spend coordinating between different service providers.

So, all services are being handled from one single source, making a CPA firm an all-in-one solution. If you’d like to know how we as a CPA firm handle all services together, book a consultation call with us.

4 – Virtual office Hong Kong: Understanding the Risks of Improper Usage

Before diving into the specifics, it’s essential to clarify what we mean when we refer to “virtual office addresses” in Hong Kong.

Although often termed virtual addresses, these are not merely postal addresses like those you might find in jurisdictions such as the British Virgin Islands, where a small mailbox suffices for receiving letters.

In Hong Kong, the government mandates that a registered office address must be a commercial address operational during normal business hours. Moreover, the virtual address provided is typically the same office address that your service provider uses. This setup underscores the importance of the service provider’s reputation, as associating your business with a disreputable or non-compliant provider can carry significant risks.

4.1 – Banking Complications:

Some virtual addresses may be flagged by banks, leading to potential issues with opening or maintaining bank accounts. This is often due to the misuse of the address by other companies, which could include fraudulent activities.

Example: If a previous tenant at your virtual address was involved in financial fraud, banks might flag all companies registered at that address, affecting your ability to open or maintain business bank accounts.

The problem is, of course, that you never know who your previous tenant was and also you have no resources (such as banks) to check whether the registered address is blacklisted.

4.2 – Legal Implications:

Using a non-compliant or disreputable virtual office service in Hong Kong can lead to legal challenges, including fines and penalties, or even revocation of your business license.

Example: A company found using a blacklisted address could face investigations and legal proceedings, which not only harm its reputation but also consume valuable time and resources.

Conclusion: A Strategic Decision with Long-term Impact

Choosing the right address for your virtual office in Hong Kong and incorporation service provider is not merely a procedural step; it’s a decision that will have a long-term impact on your business’s operations, compliance, and image. It’s crucial to partner with a reputable firm that not only provides a prestigious address but also aligns with high standards of professionalism and compliance:

Questions other readers have asked

1. Why is an office address required for a Hong Kong limited company?

An office address is required for compliance with the Hong Kong Companies Ordinance, which mandates that all limited companies must have a registered address in Hong Kong for receiving government and legal correspondence.

2. What should I look for in a virtual office provider?

Key factors to consider include the provider’s reputation, the prestige of the address, the quality of mail handling services, responsiveness to inquiries, and whether they offer additional support such as access to meeting rooms. Additionally, it’s beneficial if they have professional affiliations, particularly with CPA firms.

3. How does the choice of virtual office address impact bank relationships?

Selecting a virtual office address that has been misused by other businesses can lead to complications with banks, including difficulties in opening or maintaining bank accounts. Banks may flag addresses associated with fraudulent activities.

4. What kind of mail can I expect to receive at the virtual office address?

Most of the correspondence will be from the Hong Kong Inland Revenue Department (HKIRD), such as profits tax returns, employer’s returns, tax assessments, and other tax-related notifications. These documents are crucial for maintaining compliance with local tax laws.

5. Can a virtual office provider handle my tax-related documents?

Yes, some providers, especially those that are also CPA firms, can not only receive but also handle and advise on tax-related documents, ensuring efficient management and compliance, thus saving time and minimizing the risk of delays.

6. What are the risks of using a non-compliant or disreputable virtual office service?

Using such services can lead to legal challenges, including penalties and fines, or even revocation of your business license. It can also harm your company’s reputation and lead to banking issues.